Foreign transaction fees: Everything you need to know

There’s very little that we dislike more here at TPG than unnecessary fees — including foreign transaction fees.

You may have noticed that when you use some credit cards abroad (or on a website not hosted in the U.S.), an additional fee gets tacked on to each purchase.

Let’s discuss what those fees are and how you can avoid them in the future.

What Is a foreign transaction fee?

Foreign transaction fees are charged on certain cards when you make a purchase that goes through an overseas bank to process the transaction. When you make a transaction while traveling or through a foreign website, banks may have to convert the purchase into U.S. dollars. On some credit cards, issuers will then pass the conversion cost onto consumers.

How much are foreign transaction fees?

Visa and Mastercard charge a 1% fee to banks for processing purchases made abroad, and many U.S. issuers tack on an additional 1-2% fee. The standard foreign transaction fee tends to be around 3%. However, Capital One and Discover are unique in having zero foreign transaction fees across all their credit cards.

| Card issuer | Standard foreign transaction fee |

|---|---|

| American Express foreign transaction fee | 2.7% |

| Bank of America foreign transaction fee | 3% |

| Barclays foreign transaction fee | 2.99% |

| Capital One foreign transaction fee | None |

| Chase foreign transaction fee | 3% |

| Citi foreign transaction fee | 3% |

| Discover foreign transaction fee | None |

| U.S. Bank foreign transaction fee | 3% |

| Wells Fargo foreign transaction fee | 3% |

Which cards have no foreign transaction fees?

Most of the top travel credit cards don’t charge foreign transaction fees. In fact, it’s rare for a card that offers travel rewards and perks to charge any foreign transaction fees. While some issuers charge foreign transaction fees of around 3% on some of their products, you should consider Capital One or Discover cards since they don’t charge foreign transaction fees on any of their cards.

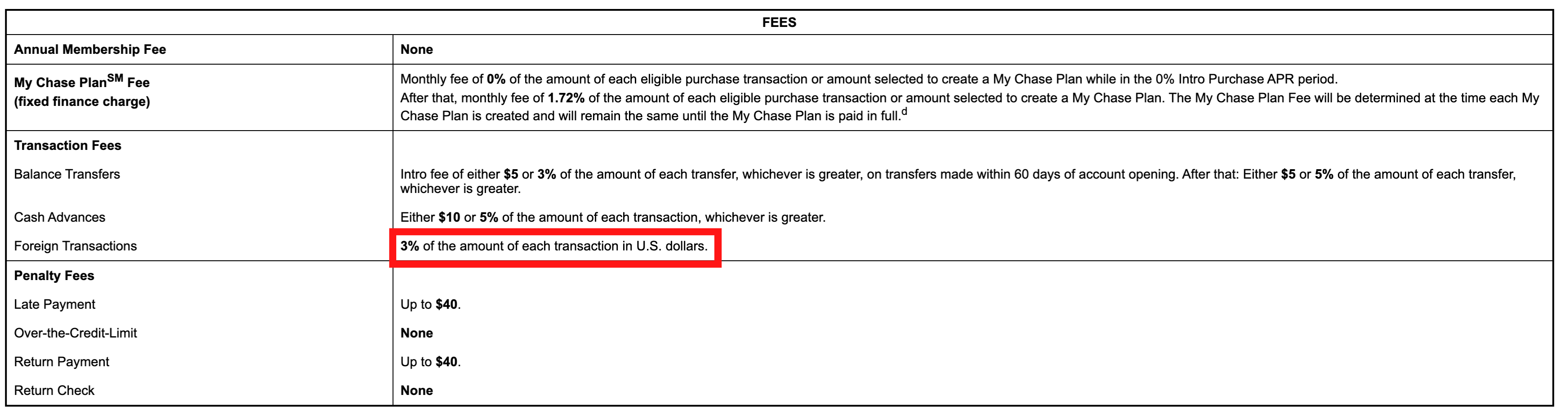

Card issuers are required to give potential and existing customers access to rates and fees associated with a credit card, including foreign transaction fees. Check the terms and conditions of your credit card to see whether or not your card (or the card you’re considering applying for) charges foreign transaction fees.

When looking at the rates and fees table, you can typically find the foreign transaction fee listed explicitly under a fees section.

Foreign transaction fees vs. ATM fees

Another type of fee you may hear about when you travel is a foreign ATM fee. While the two fees can apply when traveling outside the U.S., they are not synonymous.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

A foreign ATM fee is charged when you withdraw cash from an ATM in a foreign country. Some banks waive this fee, especially if you use an ATM that falls within a specific network of banks.

Additionally, you might be on the hook for additional fees when you use an ATM abroad, including a flat fee from your bank for using an ATM not affiliated with the bank (which is typically $5), a foreign currency conversion fee (which typically falls in line with foreign transaction fees at 3%) and additional fees charged by the owner of the specific ATM you use.

This is one reason we recommend paying with a credit card wherever possible. But in some places, cash is still king and you’ll need to have a game plan for avoiding these types of fees — or factor them into your budget.

Related: Ways to save on overseas ATM withdrawals

How to avoid foreign transaction fees

Use a card with no foreign transaction fees

The easiest way to avoid foreign transaction fees is to use a card that doesn’t charge them. TPG has a regularly updated guide on the top credit cards with no foreign transaction fees that can help you figure out the best cards to use for your trips.

Unfortunately, cash-back cards such as the Chase Freedom Unlimited® and the Blue Cash Preferred® Card from American Express (see rates and fees) tend to charge foreign transaction fees.

Avoid ‘dynamic currency conversion’

When using a card terminal abroad, you may be prompted to pay in the local currency or in U.S. dollars. You should always choose the local currency.

Dynamic currency conversion is a sneaky way that banks encourage you to pay in your home currency (U.S. dollars) while abroad. However, they’ll usually give you a poor conversion rate, so it’s best to pay in euros, pesos or whichever is the local currency.

Related: I fell for dynamic currency conversion — reader mistake story

Pay with cash

Of course, you’ll also avoid foreign transaction fees by paying with cash. But those purchases won’t earn you any rewards, and withdrawing cash abroad may be subject to pesky fees.

Bottom line

The good news is that foreign transaction fees are much less common across top credit cards than they used to be. Hopefully, the industry as a whole is moving away from charging customers these types of fees. Until then, check your credit card’s terms and conditions to know if you’ll be on the hook for a fee when you’re traveling and plan your card usage accordingly.

To avoid foreign transaction fees, choose a top travel rewards card or one from Capital One or Discover. Also, always pay in the local currency rather than U.S. dollars to avoid poor conversion rates.

Related: Best travel rewards cards

For rates and fees of the Blue Cash Preferred card, click here.