How to apply for an Amex business card

If you’ve been hesitant to apply for a small-business credit card because you’re unsure how to apply, you’re leaving points on the table. You don’t have to own a traditional brick-and-mortar business to get a business card. You may qualify if you’re a freelancer, Uber or Lyft driver or have any profitable side hustle.

American Express offers a large portfolio of business cards, so you’re bound to find something that fits your business needs. In this guide, we’ll break down the American Express business card requirements to help you answer some of the confusing application questions.

Related: What business credit cards are and how they work

Amex business card overview

Before we begin, it’s important to know that you can only earn a welcome offer for a specific Amex business card once per lifetime. This same restriction applies to Amex consumer cards. But there are several great Amex business cards to choose from, so you’ve got plenty of options.

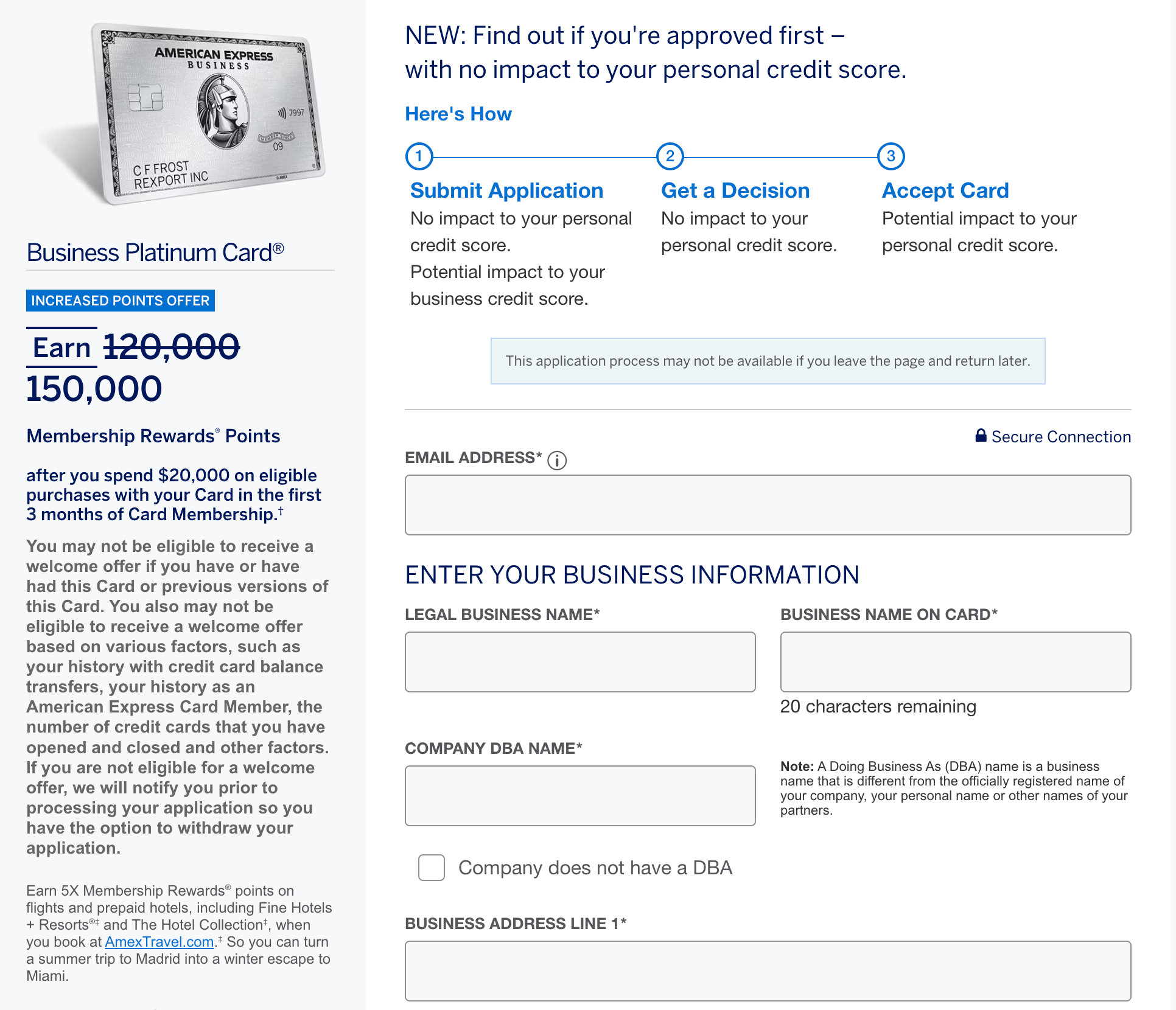

You could earn flexible Amex Membership Rewards points with The Business Platinum Card® from American Express. Currently, new cardmembers can earn 150,000 bonus points after spending $20,000 on eligible purchases in the first three months of cardmembership. You may be targeted for a higher offer through the CardMatch tool; not everyone will receive the same offers and offers are subject to change at any time.

If you’re looking for a card with no annual fee (see rates and fees), you could also opt for The Blue Business® Plus Credit Card from American Express, which earns 2 Membership Rewards points per dollar spent on every purchase on the first $50,000 spent on eligible purchases each calendar year, then 1 point per dollar spent.

Amex also issues a range of cobranded small-business credit cards. If you’re looking for points to use on award tickets for hotel stays, the Hilton Honors American Express Business Card comes with automatic Hilton Gold status. New cardmembers can earn 175,000 bonus points after spending $8,000 on purchases in the first six months of cardmembership.

Or, you could opt to earn Delta SkyMiles with one of the business Delta credit cards, offering perks such as priority boarding and a free checked bag for you and up to eight companions.

Related: The complete guide to American Express Membership Rewards partners

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

How to apply for an Amex business card

If you already have an Amex card, you can sign in to your account to shorten the application process. But if you’re new to Amex, the first page of your business card application will look like this:

Applying for an Amex small-business card is almost the same process as applying for a personal Amex card. However, there are a few differences that can be hard to navigate if this is your first time applying for a business card.

Amex business card requirements

The basic information, like your email address, is straightforward, so let’s look at the boxes that can be tricky:

- Legal business name: As a rule of thumb, you should use your name as the business name for a sole proprietor. My wife is a freelance artist and uses her name as her legal business name on card applications. However, if you have set up a legal structure for your business (LLC, etc.) or registered a name for your business (aka a fictitious name or DBA — doing business as), then you’ll put the name you registered here.

- Business name on card: This is the business name that will appear on your credit card just below the cardmember’s name (you or the authorized user). You can just put your legal business name here, although sometimes it won’t fit.

- Company DBA name: Doing business as; this is a registered name for your business that differs from the legal business name, your personal name or names of your partners.

- Business address: This can be the same as your home address if you do business from home, or it can be a separate business address.

- Business phone number: This is the primary registered business number that will be used for verification, per the application.

- Industry type: You’ll select one of a limited number of industries your business operations correspond with; examples include “agriculture,” “construction,” “non-profit” and “retail trade,” among others. You can also select “other.”

- Company structure: In most cases, your company structure will be “sole proprietorship.” You’re most likely a sole proprietor if you’re running a business by yourself. This includes most freelancers, Uber drivers, eBay resellers etc. But, if you’ve got a partner, select “partnership.” If you have set up a legal business structure (LLC, S corporation, etc.), choose “corporation.”

- Number of employees: You count as an employee, so you’ll always select at least one.

- Gross annual business revenue: This is all the money your business earns in a year before taxes or any other expenses. If you’re just starting a business, it’s OK to put zero.

- Estimated monthly spend: The amount of monthly expenses you anticipate putting on the card.

- Federal tax ID: If you’re a sole proprietor and haven’t registered for a federal tax ID, you can use your Social Security number here.

- Role in company: You are probably the owner, but if you’re not, select whichever best fits your job title.

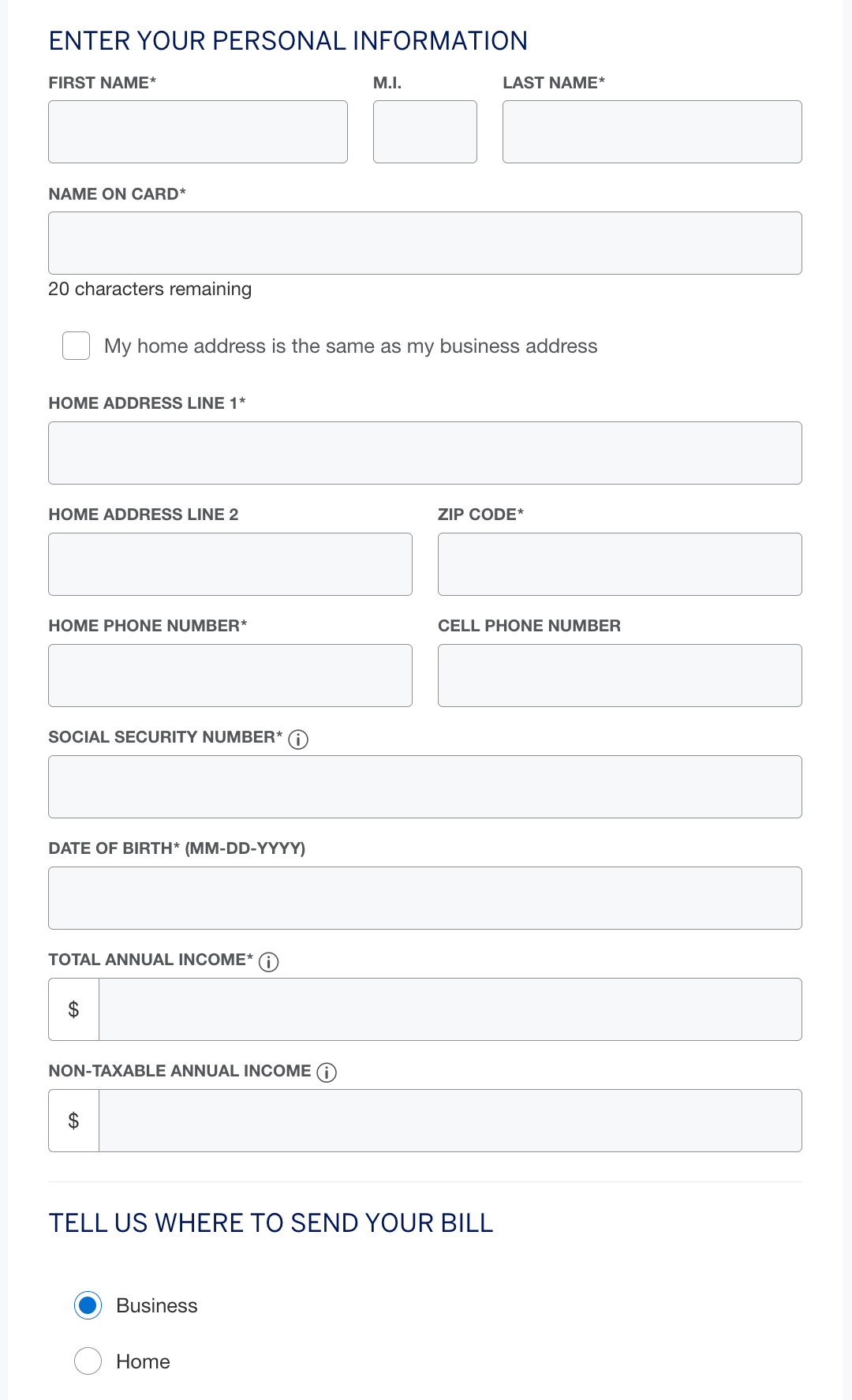

After filling out your business information, you’ll then scroll down to fill out your personal information.

Most of the questions here are straightforward, but in the “Total Annual Income” box, be sure you include all of your eligible income. This includes any income you can reasonably expect to use to pay your bills.

For me, I can include my wife’s income and my income in this section. Your “Total Annual Income” will also include any profits you’ve taken from your business.

The “Non-Taxable Annual Income” box is optional and can be left blank. Still, if you receive any income exempt from federal income tax (Social Security, child support, disability benefits etc.), you can enter that annual total.

The final step is selecting the address (home or business) where you’d like American Express to send your bill and reviewing the terms and conditions.

At this point, you can save the application and apply later or submit it for review. Often, you’ll get an instant response, but sometimes, your application can go into pending status if Amex needs further information from you.

What to do if your Amex business card application is declined

If your card application is denied or put into the pending category, one option is to call Amex’s reconsideration line (1-877-567-1083 for new accounts). Sometimes, answering a few simple questions or verifying minor details is all you’ll need to do to get an application approved.

Other times, you might be able to shift credit from existing accounts to the new card or be able to close an existing account to get your new application approved. Every situation is different, but talking to an agent on the phone is an opportunity to humanize your application — or, at the very least, find out why your application was declined.

Related: Your guide to calling a credit card reconsideration line

Bottom line

Even if you only have a part-time side hustle, you may meet American Express’ business card requirements. One advantage to applying for an Amex business card is that it won’t appear on your personal credit report, which means it doesn’t add to your Chase 5/24 count.

Because Amex limits you to earning a welcome offer for a specific card once per lifetime, applying for business cards will expand your options for earning new bonuses.

If you are any kind of business owner, follow our steps above to apply for an American Express business card to be well on your way to getting even more rewards.

Related: The ultimate guide to credit card application restrictions

For rates and fees of the Blue Business Plus, click here.