Is the Citi Premier card worth the annual fee?

Citi is a TPG advertising partner.

The Citi Premier® Card (see rates and fees) is Citi’s mid-tier travel card, earning bonus points on travel purchases and offering the ability to transfer rewards to valuable transfer partners.

But with so many other good options, is the Premier worth its $95 annual fee? Here’s what you need to know before applying.

Welcome bonus

The Citi Premier is currently offering a sign-up bonus of 60,000 ThankYou® Points points after you spend $4,000 within the first three months from account opening. TPG values these points at 1.8 cents each, making this bonus worth $1,080.

You can transfer your Citi ThankYou Points to 19 transfer partners. A good option is to use Air France-KLM Flying Blue to book business class awards from the U.S. to Europe for just 50,000 miles per person one-way.

On the hotel side, you can transfer your points at a 1:1 ratio to Wyndham Rewards and at a 1:2 ratio to Choice Privileges. These programs can both provide excellent value not just at budget properties but also when traveling near holidays when cash rates are high but points rates aren’t prone to fluctuation.

Related: 5 of the best Citi ThankYou Rewards redemption sweet spots

Solid points earning

If you ask people what they like about the Citi Premier card, the most common answer is likely that it earns points in popular spending categories.

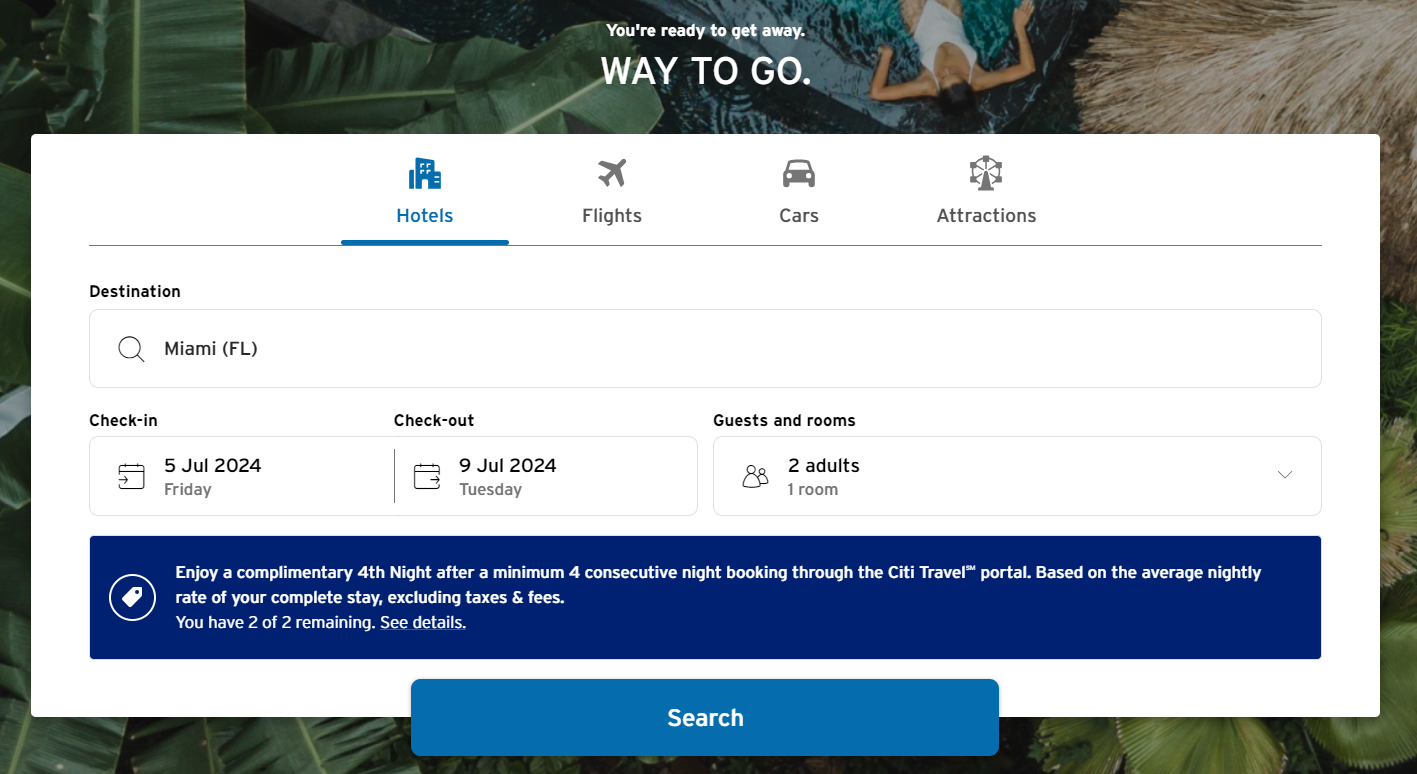

Through June 30, 2024, cardholders can earn 10 points per dollar spent on hotels, car rentals and attractions (excluding air travel) when booking through the Citi Travel portal.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

In addition, the Premier earns 3 points per dollar on air travel, hotels, gas stations, supermarkets and restaurants (including takeout) and 1 point per dollar on all other purchases.

Credit card writer Danyal Ahmed regularly uses his Citi Premier card to pay for gas and grocery shopping which helps him accumulate his ThankYou points quickly. Earning bonus points on everyday spend is what motivated him to apply for the card, in addition to Citi Premier’s transfer impressive partners.

Plus, the Premier’s bonus categories apply worldwide, as opposed to some cards that only offer these bonus points on purchases within the U.S.

Related: How to redeem Citi ThankYou points for maximum value

$100 annual hotel credit

As a cardholder, you’ll get an annual benefit of $100 off a single hotel stay of $500 or more (excluding taxes and fees) when you book through Citi’s travel portal.

However, while this benefit sounds promising and might be great when staying at boutique, independent properties, it may not yield the $100 in savings you expect.

When testing out the $100 hotel credit on the Citi Premier, TPG found that the benefit was often worth significantly less than $100. That’s because Citi’s travel portal doesn’t always have the lowest rate — especially when you factor in members-only rates for your favorite hotel chain.

Related: The Citi Travel portal is getting a complete makeover: Here’s what to expect

Cardmember protections

While the Premier lacks the extensive travel and shopping protections we love on other cards, it does offer two significant protections: extended warranty protection and damage and theft protection.

The extended warranty protection on the Citi Premier adds an additional 24 months to a manufacturer’s warranty. The damage and theft protection benefit can provide for the repair or replacement of an item that’s damaged or stolen within 90 days of purchase (up to $10,000 per item and a $50,000 annual limit).

World Elite Mastercard benefits

As a World Elite Mastercard cardholder, you can enjoy extra perks like Global Emergency Services, a $5 Lyft credit when you take at least three rides in a month and a ShopRunner membership that provides free two-day shipping for numerous online purchases.

Entertainment perks

Anyone with a Citi credit card, including the Citi Premier card, can access Citi Entertainment. This can provide access to exclusive events and priority access or advance ticket sales to concerts, shows and performances, film festivals and more.

Bottom line

Since you may not get the full $100 value from the hotel benefit, whether the Citi Premier is worth its $95 annual fee will come down to the points you earn and how you value them.

If you can maximize the bonus categories and get good value from Citi’s transfer partners, you may find you get value well beyond the annual fee cost. However, if you want more tangible value from statement credits and other perks, you’ll likely want to go with a different credit card.

Apply here: Citi Premier® Card with a 60,000-point welcome bonus after you spend $4,000 on your card within three months of account opening