Why to get and keep the IHG One Rewards Premier Credit Card

Whether you stay at IHG hotels and resorts a few times each year or weekly, you should seriously consider getting — and keeping — the IHG One Rewards Premier Credit Card.

This card offers a compelling sign-up bonus to attract new cardholders. But it is one of my favorite cards to keep long-term due to its many perks that can easily offset its modest $99 annual fee.

Here’s why I love my IHG One Rewards Premier card and plan to keep it in my wallet for the foreseeable future.

Sign-up bonus

If you apply for the IHG One Rewards Premier Credit Card by Wednesday, you can earn 165,000 bonus points after spending $3,000 on purchases within the first three months of account opening.

Based on TPG’s valuations, 165,000 IHG points are worth about $825. However, since the IHG One Rewards loyalty program uses dynamic award pricing, the number of award nights you’ll get from 165,000 IHG points will depend on when and where you redeem your points.

However, note that the IHG One Rewards Premier card and its sign-up bonus aren’t available if you are a:

- Current cardmember of any personal IHG One Rewards credit card

- Previous cardmember of any personal IHG One Rewards Credit Card and received a new cardmember bonus within the last 24 months

The Chase 5/24 rule may also prevent you from being approved for a new Chase credit card. Check out our post on calculating your 5/24 standing for more information.

Related: Is the IHG One Rewards Premier card worth the annual fee?

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Anniversary night

Even if you don’t spend many nights in hotels or prefer a different hotel loyalty program, the IHG One Rewards Premier Credit Card may still be worth its $99 annual fee. After all, most cardholders can get more than $99 of value each year from one benefit: the IHG anniversary night certificate you receive after each account anniversary.

You can use the anniversary night for a night with a redemption rate of 40,000 points or less. But you can also add-on points from your IHG One Rewards account to redeem for a night costing more than 40,000 points. You must redeem your night and complete your stay within 12 months of the free night’s issue date.

I’ve gotten good value from my anniversary nights over the years. But as long as you’re getting more than $99 of value from your anniversary night certificate each year, keeping the IHG One Rewards Premier card long-term likely makes sense — especially once you consider the card’s other perks.

Related: The 19 best IHG hotels in the world

Fourth-night reward perk

My favorite perk of the IHG One Rewards Premier Credit Card is the “redeem three nights, get fourth reward night free” benefit. In short, this perk lets you pay zero points for every fourth night when you redeem IHG points for a stay of four nights or longer.

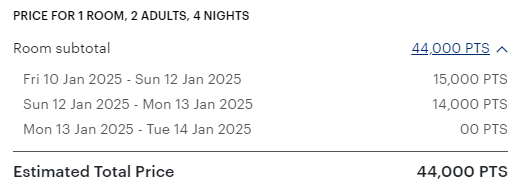

Let’s look at an example. For the following stay, I’d pay zero points for my fourth night due to the IHG fourth-night reward perk.

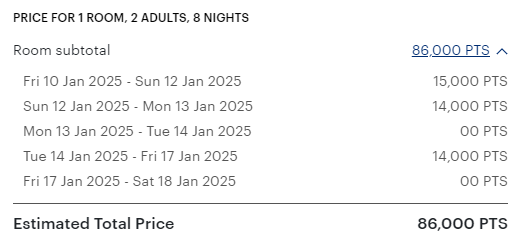

This perk also works for longer stays. For example, here’s an eight-night stay where my fourth and eighth nights would cost zero points after the fourth-night reward perk.

Every fourth night will cost zero points regardless of whether these nights are the cheapest or most expensive of your stay. You can use this benefit an unlimited number of times. So, if you frequently redeem IHG points for stays of four nights or longer, this card benefit will likely save you a significant amount of points.

Related: How much value does IHG One Rewards status provide when you book directly?

Other valuable benefits

The IHG One Rewards Premier Credit Card offers other useful benefits to cardholders, including:

- Automatic IHG Platinum Elite status for as long as you keep your IHG One Rewards Premier card, plus the ability to earn Diamond Elite status through the end of the following calendar year during any calendar year you make purchases totaling $40,000 or more with your IHG One Rewards Premier card

- No foreign transaction fees

- A Global Entry, TSA PreCheck or Nexus credit of up to $100 every four years as reimbursement for an application fee charged to your card

- Earn a $100 statement credit and 10,000 bonus points each calendar year you spend at least $20,000 in purchases

- A $25 United TravelBank cash deposit in your MileagePlus account twice a year (on or around Jan. 5 and July 5) once you complete a one-time registration for this perk

Plus, you’ll earn 10 points per dollar at hotels participating in IHG One Rewards, 5 points per dollar on other travel, gas stations and dining at restaurants (including takeout and eligible delivery services), and 3 points per dollar spent on other purchases with your card.

Related: The best hotel credit cards with annual fees under $100

Bottom line

The IHG One Rewards Premier Credit Card offers new cardholders who apply by Wednesday a sign-up bonus of 165,000 points after spending $3,000 on purchases within the first three months of account opening.

Even once you have the IHG Premier card, two card benefits — the anniversary night certificate and the fourth-night-reward perk — should provide significantly more value than the $99 annual fee each year. As such, I believe the IHG One Rewards Premier card is valuable to get and keep long-term.

Check out our IHG One Rewards Premier Credit Card review for more details.

Apply here: IHG One Rewards Premier Credit Card